The short answer is yes. Solar is a great way to counter unpredictable and volatile energy prices. This is especially true for companies and businesses with large energy consumption, where rising costs can significantly impact their bottom line and competitiveness in the market. Fortunately, solar power can help reduce that risk.

What is Energy Price Risk?

Energy price risk refers to the negative impacts that a fluctuating energy market can have on energy consumers. With the uncertainty of what the future holds, fluctuating electricity prices are of major concern, as increased future energy prices will have severe impacts on a business’s ability to correctly budget and forecast their future costs.

Energy prices are inherently volatile, subject to changes in supply and demand, weather patterns, geopolitical events, government policies, regulations and an overarching reliance on fossil fuels. In recent years, the use of renewable energy sources such as solar power has increased significantly, giving businesses an effective way to hedge against the volatility of energy prices.

How Can Solar Power Help Hedge Against Energy Price Risk?

Reducing businesses' dependence on the grid by installing solar provides a predictable, stable source of energy with long-term savings. When you install solar, you generate your own electricity reducing your onsite consumption, insulating your business from sudden changes in energy prices, leaving you less susceptible to market volatility.

While the upfront costs of installing a solar system can be significant, you are locking in a portion of your energy costs for the lifespan of your solar panels, which can be up to 25 years or more. This partnered with low operation and maintenance costs provide a level of certainty in your energy costs that you would not have if you were relying solely on grid-supplied electricity.

Currently investing capital into a solar system provides the ability to produce Large Generation Certificates (LGCs), a certificate that liable entities are required to surrender annually. This government incentive provides businesses with the option to forfeit the LGCs to help reach their renewable targets, or alternatively, sell the LGC's for additional revenue until the end of the scheme in 2030. Current certificate spot prices can be followed on the Demand Register, as of February 27th 2023 LGCs are selling at around $42.5 per MWh but these were seen as high as $70 in September of 2022.

Alternatively to purchasing a system outright, a Power Purchase Agreement (PPA) can also be an effective way to hedge against the energy market. A PPA is a long-term agreement between a solar Installer and an energy user, in which the energy user agrees to purchase electricity generated at a fixed price.

With PPA providers offering flexible terms between 1 & 25 years businesses would have more certainty around the price they pay for electricity. Also, depending on the PPA agreement, once the PPA term is over the energy user may be gifted the asset.

Solar power can also provide a hedge against the potential for future carbon pricing or taxes. As governments around the world move to address climate change, there is a growing likelihood that carbon pricing or taxes will be implemented. By generating your own electricity from solar power, you can reduce your carbon footprint and potentially avoid these additional costs.

So how does this look in a real-case scenario?

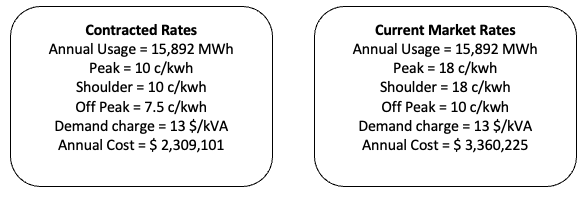

Let’s say your business operates a production or manufacturing plant that relies solely on grid-provided electricity. your current electricity contract is nearing its end, so you will be at the mercy of the electricity market that is currently trading at the below rates.

This increase in energy prices would have a major impact on the sites operational costs, estimated at a 31% increase. This kind of increase could have a significant impact on the business's overall profitability. Now let’s look at how solar could help you hedge against the expected electricity costs.

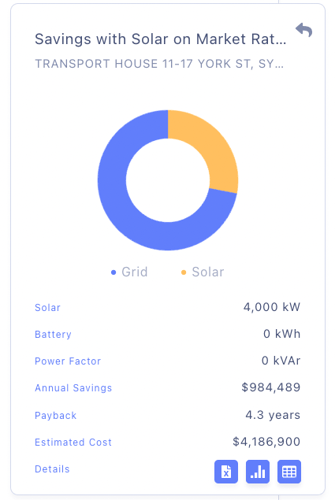

In this example, we will aim to install a 4MW system, the solar system would decrease the annual grid consumption by 4,457MWh or 28% providing a massive reduction in electricity costs.

Calculating the reduction in energy costs, demand charges and the additional revenue created from LGC's, the system would generate an estimated saving of $985,000/yr, equivalent to a 29% reduction on annual electricity cost. This almost offsets the entire increase in costs that the business would face once subjected to the new electricity rates. At this rate the solar system would pay itself off in just over 4 years.

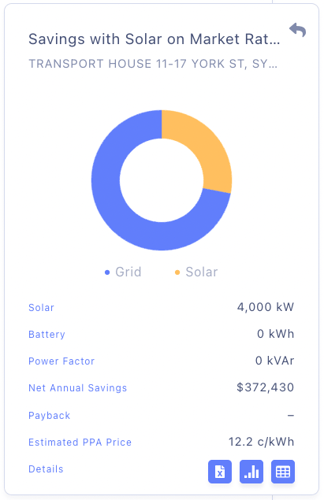

Alternatively, you can use a PPA structure to offset your price increase and outlay no upfront capital. A PPA term provides you with a locked-in rate for the solar generated over your selected term. The example above shows a net annual savings of $377,230 with an estimated 10-year PPA price of 12.2 c/kWh. These savings will reduce the price hike by 11% with no initial investment cost, and you receive the asset after the PPA period ends.

As an added benefit, the solar system provides a massive reduction in CO2 emissions. for a system of this size, you are looking at an annual emission reduction of around 4,000 tCO2/yr, offsetting the annual road use of roughly 2000 cars.

Solar power is a reliable solution for businesses seeking to manage energy price risk, reduce reliance on the grid and insulate their exposure to the energy market while improving their sustainability credentials. While there are upfront costs when installing solar power, the potential for long-term cost savings and carbon reduction makes it a worthwhile investment. While exploring your solar options, it's crucial to work with experienced Solar Retailers who can help design a system that meets your specific business needs. If you're interested in seeing how Solar can help mitigate your business's energy risk start a free solar assessment by clicking the button below.