Solar Panels

Through Q1 of the 2024 calendar year Trina was the most offered panel by solar retailers with 41%. Jinko, JA and Longi were all mostly equal with 13-17% each.

This was a roughly similar trend to the panels used in the executed contracts with customers. Trina was the panel used for 60% of the contracted installations, almost 20% higher than it was offered. REC also saw a large jump from being offered 3.9% of the time to being contracted for 20% of the installs. Although JA Solar was the 3rd most offered panel no projects were contracted using it.

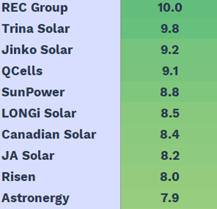

Beam Solar scores the 4 panel manufacturers selected for the contracted installations highly in our equipment scoring, all being in the top 6. JA is ranked a bit lower at 8th which may be why no customer chose to contract with a solar retailer offering it.

Note: these scores are only for the manufacturer, largely trying to identify how likely they will be around to honor their warranties in the future. Beam Solar also scores the stats of the specific models of products offered as well as the overall solution design for offers.

Solar Inverters

Of the inverters offered in Q1 of the 2024 calendar year Sungrow owned over 80% of the market share with all other inverters being offered at most 5% of the time

Similarly, Sungrow was the chosen inverter brand 80% of the time for contracted projects. SolarEdge took the remaining 20%.

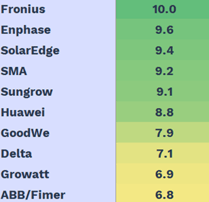

Interestingly Sungrow is only ranked 5th in our inverter manufacturer scoring. It appears to be receiving such high market share by being the most cost effective inverter with a relatively high score.

Note: these scores are only for the manufacturer, largely trying to identify how likely they will be around to honor their warranties in the future. Beam Solar also scores the stats of the specific models of products offered as well as the overall solution design for offers.

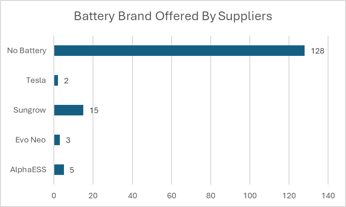

Batteries

Of the 153 offers received for customers 25 of them included a commercial battery. The majority were Sungrow with some Tesla, AlphaESS and EVO NEO.

No customer entered a contract with a supplier offering a battery in Q1 2024.

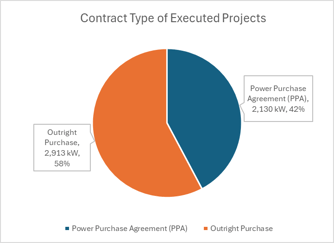

Outright Purchase Vs Power Purchase Agreements (PPAs)

Of the contracts executed in Q1 2024 all were either Outright Purchase or PPAs. An article on the pros and cons of these two options can be found here: https://blog.beam.solar/knowledge-base/whats-a-power-purchase-agreement-ppa

58% of the installations were Outright Purchase compared to 42% being PPAs.

Other Contractual Inclusions

Of the 2,913 kW of executed Outright Purchase contracts none of the projects included a Performance Guarantee and Maintenance Contract. Customers likely did not view the additional cost for the Performance Guarantee being worth it as they mitigated underperformance risks via other contractual inclusions.

All Outright Purchase contracts included a minimum 10 year Full System Warranty as well as the 3rd party SolarAnalytics monitoring with 10 year prepaid subscription which notifies the customer if the system is ever underperforming.

All executed Outright Purchase contracts included a defect liability period of 12 months with 2.5%-5% securities.

If you are interested to start the solar procurement journey for your business, feel free to reach out to commercial@beam.solar or book a meeting via the link below: